Ag Marketing IQ: Ponder the production woes and managed money whims, while taking advantage of this harvest rally.

Jason Meyer, Hedging strategist

Before we figure out what’s driving higher market prices, let’s take a quick look at the Quarterly Grain Stocks Report released by the UDSA last week.

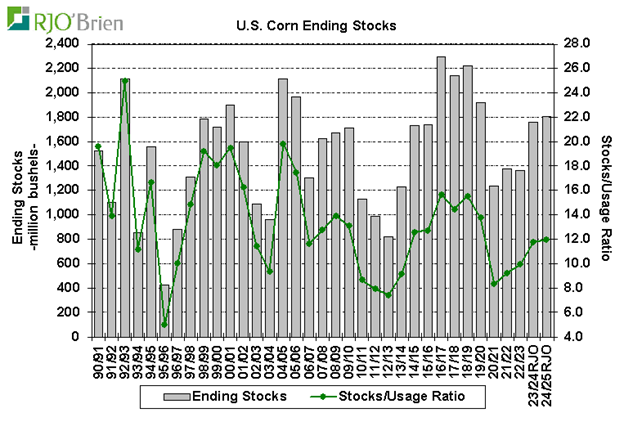

Corn surprised the market. USDA stated carryout at a 1.760 billion bushels when the market was looking for around 1.844 billion bushels. The reason for the discrepancy: higher usage stemming from lower prices.

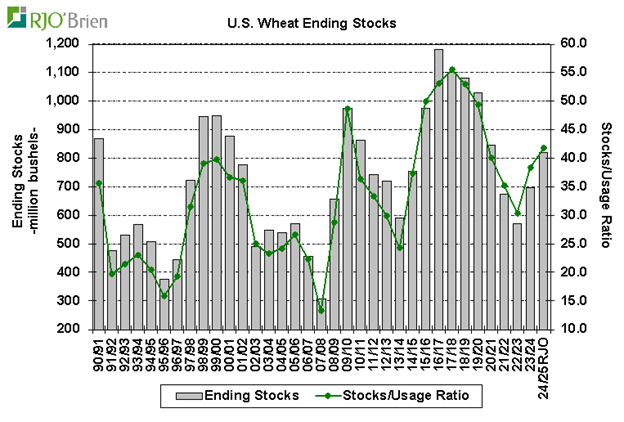

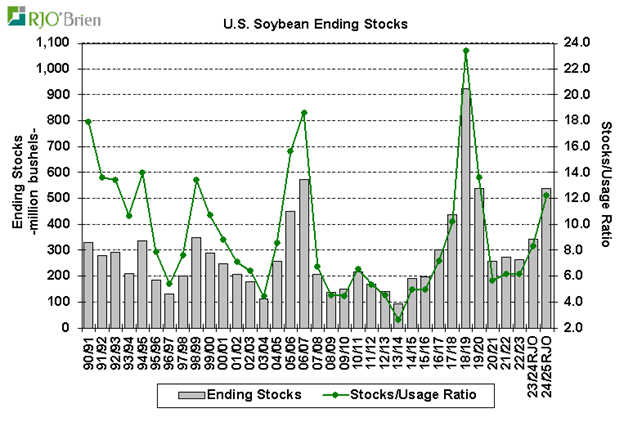

Soybeans and wheat stocks came

in close to the market’s expectations.

Many farmers are asking: “Why?”

A quick look into the “Why” shows that ongoing dry weather in South America continues to garner the market’s attention.

This is similar to what the U.S. producer experienced in February/March. As the weeks progressed, the extreme drought situation across the U.S. eased and erased moisture deficits. As Brazil gets into the wetter season, look for drought conditions to improve.

Secondly, China recently injected a stimulus package, which some have surmised may lead to a bigger appetite for U.S. grain. The main reasons for the injection: help counter deflationary pressure, spur on consumer spending and help prop the real estate market.

Thirdly and most importantly, managed money covering the record short position they established in July.

As of the latest Commitment of traders Report on Sept. 27, managed money has covered over a billion bushels of corn positions and almost 554 million bushels of soybeans. Major reasons for covering these positions include: the lack of August and September rains in key U.S. growing areas, geopolitical risks in the Middle East supporting energy values, a potential increase in U.S. export business as cuts to EU crops have occurred and the continued concerns over access to Black Sea crops.

Marketing based on weather ‘only’ is extremely difficult. What’s even more difficult? Trying to figure out what direction the managed money crowd leans on a particular week.

Don’t try to outguess the market. Remain flexible in your marketing decisions and be ready to quickly adapt to the changing tides. Similar to last year, a rally during harvest may be your best marketing opportunity for cash bushels until next summer.

Have questions on how to stay flexible in marketing? Feel free to contact me directly at 314-626-4019 or anyone on the AgMarket.Net team at 844-4AG-MRKT.